Silver's 2026 Explosion: Why the Only Safe Bet is Physical (And Hand-Poured is King)

The silver market is sitting on a powder keg, and 2026 might just be the year it detonates.

With silver already trading above $80 per ounce: a level that would have seemed fantasy just two years ago: and gold soaring past $4,450, we're witnessing something unprecedented. This isn't your typical precious metals rally. This is a perfect storm of industrial hunger, supply shortages, and geopolitical chaos converging into what could be the most explosive precious metals market in decades.

The Setup: Why 2026 Is Different

The numbers tell a story that's impossible to ignore. HSBC, one of the world's largest banks, just revised their 2026 silver forecast upward to $68.25 per ounce: up from their previous $44.50 estimate. But here's the kicker: they're projecting a trading range of $58 to $88, with some aggressive analysts expecting silver to break above $100.

What's driving this seismic shift? Three forces that have never aligned quite like this before.

Industrial Demand Gone Nuclear

Silver isn't just a shiny metal anymore: it's the lifeblood of the modern world. Solar panel production alone consumed over 25% of the entire global silver supply in 2024, and that number keeps climbing. Electric vehicles, 5G infrastructure, AI data centers: every piece of our tech-driven future demands silver. Unlike gold, which sits in vaults looking pretty, silver gets used up and disappears forever into industrial applications.

The math is brutal: we're burning through silver faster than we can dig it out of the ground.

Supply Deficit Reality Check

Here's where it gets interesting. The global silver deficit: the gap between what we mine and what we consume: hit approximately 230 million ounces in 2025. While it's expected to narrow to around 140 million ounces in 2026, we're still talking about a massive shortfall that shows no signs of disappearing.

HSBC's James Steel points to "extreme backwardation on CME futures and tightness in the London market" as clear signals of a shortage in deliverable metal that "may not be resolved until later in 2026." Translation: there's not enough physical silver to meet demand, and the paper markets are starting to crack under the pressure.

Geopolitical Chaos Multiplier

Add in policy uncertainty around U.S. trade measures and critical minerals designations, and you've got a recipe for supply disruption. Silver isn't just precious anymore: it's strategic. When governments start hoarding critical materials, private citizens better pay attention.

Why Physical Metal Is Your Only Real Shield

This brings us to the critical question: when the silver market finally explodes, where do you want to be positioned?

If you're holding paper silver: ETFs, futures contracts, mining stocks: you're essentially betting on promises. Sure, ETFs are creating demand and driving prices higher, but what happens when everyone tries to redeem their paper for actual metal at the same time?

Physical silver in your hands eliminates counterparty risk entirely. No bank can fail on you. No government can freeze your account. No exchange can suspend trading. It's yours, period.

But here's where most people miss the bigger picture: not all physical silver is created equal.

The Hand-Poured Advantage: Why Authenticity Matters More Than Ever

In a world increasingly flooded with counterfeit bars and digital promises, hand-poured silver stands apart like a lighthouse in a storm.

Unmistakable Authenticity

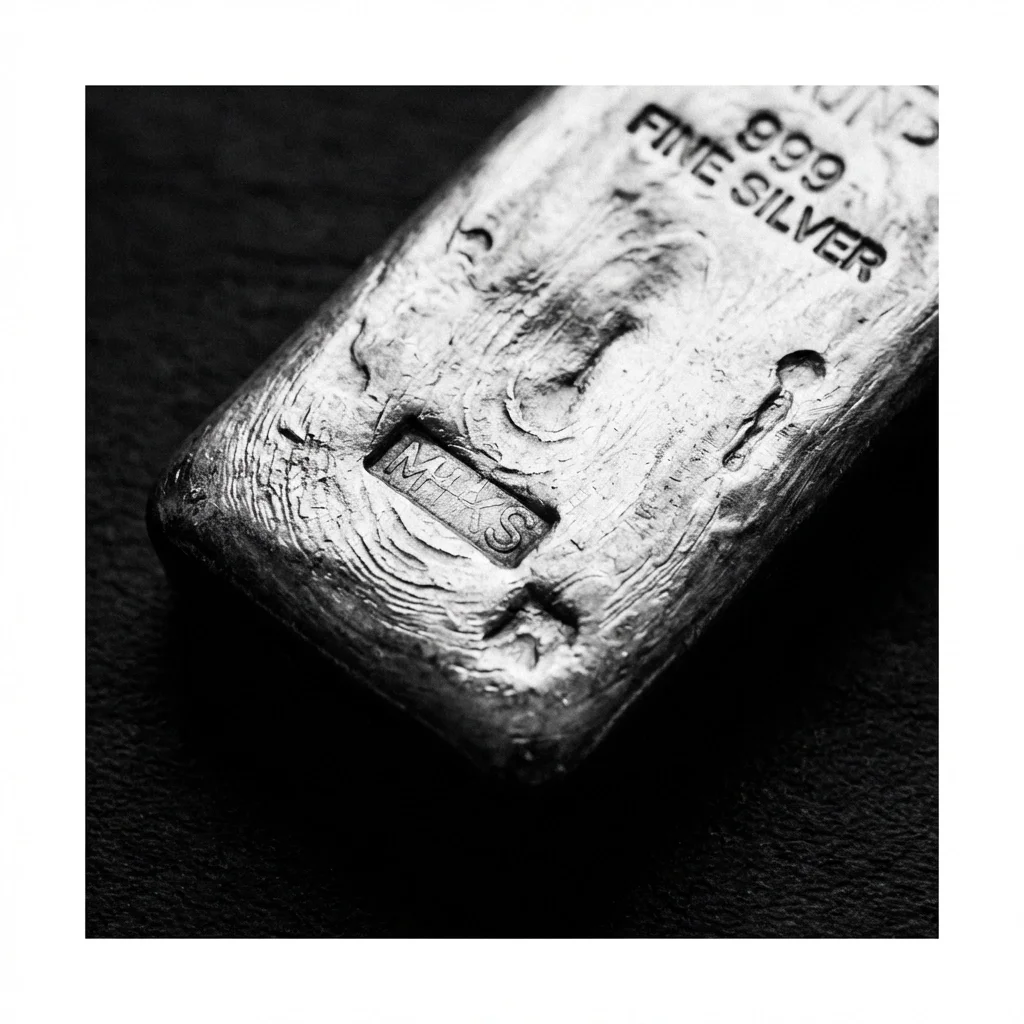

Mass-produced bars roll off assembly lines by the thousands, looking identical and easily counterfeited. Hand-poured pieces? Each one bears the unique marks of its creation: pour lines, slight variations in thickness, individual character that's impossible to fake at scale. When silver hits triple digits and counterfeiting becomes profitable, you'll want pieces that are immediately recognizable as genuine.

Visible Craftsmanship

There's something powerful about holding a piece of silver that was individually crafted. You can see the pour marks, feel the slight irregularities, know that human hands shaped this specific piece of metal. It's not just silver: it's silver with a story, with character, with undeniable authenticity.

Serialized Uniqueness

Many hand-poured pieces carry individual serial numbers, maker's marks, or distinctive characteristics that make them as unique as fingerprints. In a market where verification matters more than ever, these individual identifiers add another layer of security and authenticity that mass-produced bars simply can't match.

The Tipping Point Is Now

The silver market is exhibiting all the classic signs of a commodity on the verge of a major breakout. Persistent deficits, industrial demand growth, supply chain disruptions, and most importantly: physical market tightness that's getting worse, not better.

Major financial institutions are revising their forecasts upward, not because they're bullish on precious metals philosophically, but because the fundamental supply-demand mathematics are impossible to ignore.

When HSBC talks about market tightness that "may not be resolved until later in 2026," they're essentially saying the shortage could persist for the entire year. When silver shortages stretch across multiple years, prices don't just rise: they explode.

Positioning for the Inevitable

The question isn't whether silver will continue its explosive rise: the fundamentals make that nearly inevitable. The question is how you'll participate.

Paper products might capture some price appreciation, but they come with counterparty risk, liquidity concerns, and the constant nagging question of whether there's actual metal backing those claims.

Physical silver eliminates those worries entirely, but quality and authenticity matter more than ever. Mass-produced bars might be silver, but hand-poured pieces are silver plus authenticity, plus craftsmanship, plus individual character that can't be counterfeited or mass-produced.

As industrial demand continues devouring supply, as governments designate silver as a critical material, as the gap between supply and demand widens: those holding authentic, verifiable, physical silver will be positioned for whatever comes next.

The silver explosion isn't coming. It's already here. The only question is whether you're holding the right kind of silver when the dust settles.

In a world where digital promises can evaporate overnight and paper claims can be suspended or frozen, there's something reassuringly solid about hand-poured silver sitting in your safe. It's real. It's yours. And it's ready for whatever 2026 throws at the markets.

The smart money isn't just buying silver: it's buying the right kind of silver. The kind you can hold, verify, and trust completely.

Because when the silver market truly explodes, authenticity won't just be valuable( it'll be everything.)